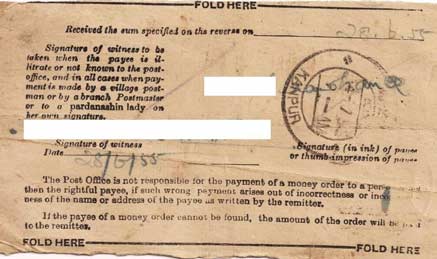

135-year-old legacy comes to an end! Like in the case of the telegram, India Post has quietly discontinued the traditional money order service, which was an integral part of the department since 1880, facilitating pan-India door-delivery of funds to a payee from over 1.55 lakh post offices.

The traditional system couldn’t keep up with the modern instant communication standards.

In an era of instant communications, the traditional money transfer facility has made way for an electronic version, which was introduced in October 2008, thanks to the proliferation of mobile telephony and data communications in the country through the internet — 18 months after they led to the demise of the telegram.

“Yes, the traditional money order as we know it has been discontinued,” said Shikha Mathur Kumar, Deputy Director General for Finance with India Post based in the national capital. “What we have now are electronic money orders, or eMO, and instant money orders, or iMO, systems,” Mr. Kumar told IANS.

“Both these are much faster and simpler means to remit money.” The iMO system, according to India Post, provides instant money order service for amounts ranging from Rs.1,000 to Rs.50,000. An instant, web-based system, money can be remitted by designated iMO post offices – where an electronic version of a form is filled along with an identity proof.

Once the money is transferred electronically, along with one of the 33 standard messages that can be chosen by the remitter, the payee can visit the post office and receive the money on producing a proof of identity. The money can also be be credited to the savings bank of a payee.