Stock market slips on Monday; Sensex falls by over 300 points; Nifty by over 100 points

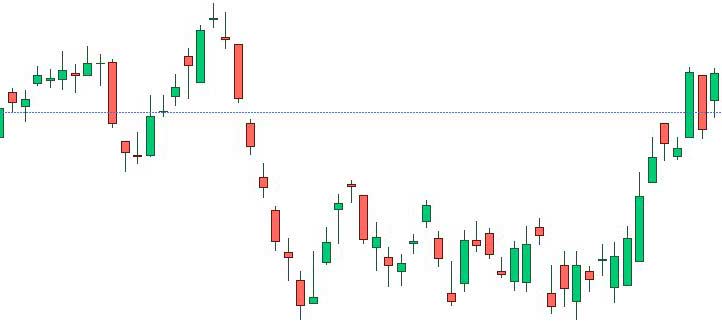

The first trading day of the week proved disappointing for the Indian stock market. Benchmark indices closed in the red on Monday amid heavy volatility and significant selling pressure in heavyweight stocks. The Sensex closed down 324.17 points (0.39%) at 83,246.18, while the Nifty 50 slipped 108.85 points (0.42%) to 25,585.50. The market opened flat, but increased selling in select large-cap stocks in the afternoon session prevented the indices from recovering.

Weak Results from Large-Cap Companies

The third-quarter (Q3) results of heavyweight companies like Reliance Industries and ICICI Bank disappointed investors. Wipro shares witnessed a sharp decline of over 8%, primarily due to a decline in profits and weak future guidance.

Global Geopolitical Tensions

Uncertainty prevailed in global markets after US President Donald Trump warned of imposing new tariffs on European countries. This directly impacted the Indian stock market.

Selling by Foreign Institutional Investors (FIIs)

Foreign investors continued to withdraw capital from the Indian market today, adding to the pressure on the market.

Sectoral Performance

The realty, IT, and oil and gas sectors were the worst hit in today’s trading. While FMCG and auto sector stocks attempted to stem the decline, they were unable to support the overall market.

Investors’ wealth declines

The market downturn led to a significant decrease in the total market capitalization of companies listed on the BSE, resulting in losses of crores of rupees for investors. The prices of silver and other precious metals surged as investors shifted from the risky equity market to safer investments.