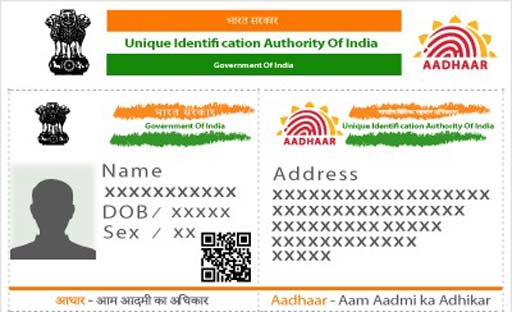

Government extends Aadhaar-PAN linking date to December 31

The deadline to link PAN card to Aadhaar card has been increased once again by the Income Tax Department. Now the new deadline is December 31. Earlier this deadline was ending on 30 September. A notification in this regard has also been issued by the department. This move of the government will provide relief to those who have not yet linked their PAN card to Aadhaar. By December 31, if the PAN card is not linked to Aadhaar, it will become inoperative, that is, you will not be able to do financial transactions with it.

High court also declares it mandatory

According to the notification issued on 31 March, the Finance Ministry had clearly stated that if one has both PAN and Aadhaar card, it is mandatory to link them. Earlier this year, the High Court also upheld Section 139AA of the Income Tax Act, making the PAN-Aadhaar link mandatory.

How to link Aadhaar-PAN card

- Open the e-filing website of the Income Tax Department www.incometaxindiaefiling.gov.in in a web browser.

- Click the red colored link Adhaar on the left here.

- If your income tax account is not created then register.

- On clicking, the page will open, in which you will have to fill your Aadhaar number, PAN number and name according to Aadhaar.

- Then type the captcha code provided.

- After filling the information, click on the link Adhaar option shown below.

- After this your PAN card will be linked to Aadhaar.

You can know the status of Aadhar PAN card link

- Go to the website of the Income Tax Department www.incometaxindiaefiling.gov.in.

- There is an option called Link Aadhaar here.

- After clicking on it, a window will open.

- In this window, you have to click on Click here blinking in red color.

- A new page will open, providing PAN card number and Aadhaar number.

- After this, you will know the status of being a card link.